South Africa is one of the most carbon intensive economies in the world, ranked as the 11th largest contributor to Greenhouse Gas (GHG) Emissions, due to the economy’s heavy reliance on fossil fuels.[1] Scientists are concerned that South Africa will be at risk of prolonged dry spells and intense rainfall in the future that may lead to increasing drought and flooding risks. However, economist have warned that the most significant risk facing South Africa is the potential R2 trillion economic transition risk that may occur as the economy moves towards carbon neutrality.[2]

While this may seem disparate from the world of banking, insurance and asset management, the South African financial sector must manage its own climate risk as the economy transitions. As the global economy weans itself off carbon intensive fossil fuel activity, the transition could lead to uncertainty and volatility in market prices, lower creditworthiness among carbon intensive clients, and the build-up of concentration risk and stranded carbon intensive assets.

The release of the “Proposed Guidance on Climate-related Metrics, Targets and Transition Plans” by the Task Force on Climate-Related Disclosure (TFCD) – as well as the increased demand for information on financial institutions’ activities related to climate change initiatives – has pushed the need for climate-related financial risk (CRFR) reporting beyond high level exposure analysis and into the complex world of financed emissions and greenhouse gas (GHG) emission accounting and reporting.

Task Force on Climate Disclosure Report, 2017

A significant development of climate-related financial reporting and disclosure was the publishing of the Financial Stability Board’s Task Force on Climate-Related Disclosures recommendation report in 2017. The Report defines principles around the governance, strategy, risk management, metrics and targets related to climate-related financial disclosures. While the recommendations are voluntary, the TFCD recommendations have been acknowledge by South Africa’s National Treasury, as well as a number of international regulators and governments, as one of the core foundational guidelines.

The 2017 Report included supplemental guidance for the financial sector across the activities of lending, underwriting, asset management and investing. With the release of the consultatory document title “Proposed Guidance on Climate-related Metrics, Targets and Transition Plans” in June 2021, however, these recommendations may soon expand to include GHG accounting that will develop metric and reporting disclosure beyond simple exposure analysis. This will require banks to report calculated metrics that reveal their contribution to both direct and indirect emission.

While the 2021 Consultation Report applies to the financial sector in general, this article will focus specifically on the banking industry.

Proposed Guidance on Climate-Related Metrics, Targets and Transition Plans Report, 2021

Originally the TFCD recommended metrics for banks that assessed the impact of climate-related risks on their lending and other financial intermediary activities. This is essentially an exposure analysis across credit, equity, debt, and trading positions that should be broken down across four attributes:

This should be used to provide insights in a similar manner to the European Union’s Green Asset Ratio (GAR) that banks must report by the end of 2022. The GAR presents the proportional extent to which the financial activities of the bank are associated with “green” economic activities as defined by the EU taxonomy. Along with additional disclosure, this would give an investor an idea of how exposed a bank may be to industries that will be impacted by transitional risk.

The most significant proposed update to the TFCDs’ recommended disclosures for banks is the reporting of the various greenhouse gas classifications and their risks. The widely used GHG Protocol Corporation Standard classifies GHG emissions, specifically carbon dioxide and the carbon dioxide equivalent of various other gases, across 3 categories:

-

Scope 1: Direct emission from owned or controlled sources

-

Scope 2: Indirect emissions from the generation of purchased energy

-

Scope 3: Indirect emissions (excluding scope 2) that occur across the entire value chain of the company.

Scope 3 specifically includes financed emissions - the emissions resulting from the activities linked to the investments, lending, insurance and other financial services offered by financial institutions. These are naturally the most significant factors when reviewing the climate impact of financial institutions.

The proposed requirement to disclose financed emission metrics is a significant and complex task which will require banks to come to terms with the necessary methodologies and the various operational challenges that exist. To provide clarity and standardisation across the banking industry, the TFCD has recommended adhering to the Partnership for Carbon Accounting Financials’ (PCAF’s) Global GHG Accounting and Reporting Standard for the Financial Industry.

Partnership for Carbon Accounting Financials’ GHG Accounting Methodology, 2020

The PCAF is a global initiative that aims to assist and guide financial institutions on the practise of GHG accounting – the assessment and disclosure of the greenhouse gas emissions related to scope 3 investments across a fixed point in time in line with financial accounting periods. The PCAF hopes to fill a critical gap in climate-related disclosure by developing a global, standardised GHG accounting approach that focuses on:

-

Defining the recognition approaches for GHG accounting

-

Classifying financial institutions’ loans and securities across six major asset classes

-

Methodological guidance for each asset class

1. Defining the recognition approaches for GHG accounting

Banks will need to choose either the financial or operational control approach to measure and report financed emissions. Under the financial control approach, if the bank can directly influence financial and operational policies of the company, the bank will report 100% of emissions as if these emissions were its own. Under the operational control approach, if the bank or one of its subsidiaries has control over the implementation of operational policies the bank will report 100% of emissions as if these emissions were its own. However, if the bank owns an interest but does not have control, it accounts for the institution’s emissions under its scope 3 emissions, according to its relative share of ownership.

2. Classifying financial institutions’ loans and securities across six major asset classes

Financed emissions are measured differently due to the idiosyncrasies of different asset classes with the PCAF providing methodological guidance for each asset class. Therefore, banks must determine and allocate their loans and securities based on the set principles provided by the PCAF.

3. Methodological guidance for each asset class

Each asset class has a distinct methodology that provides details regarding:

a. Asset class definition

b. Emission scopes covered

c. Attribution of emissions

d. Equations to calculate financed emissions

e. Data required

f. Other considerations

g. Limitations

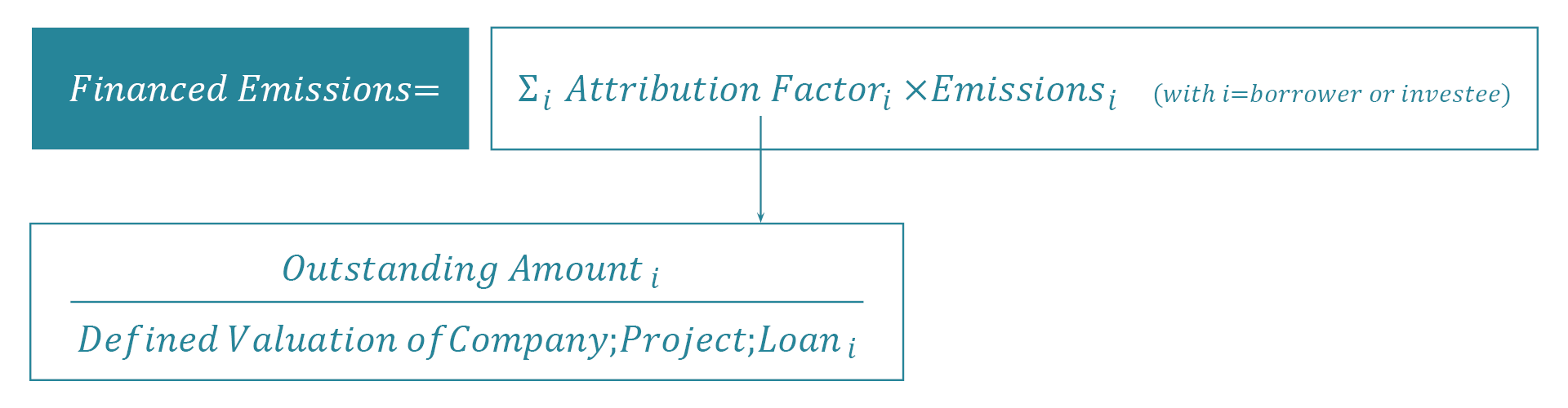

In order to determine financed emissions attributable to the bank, the Standard follows a similar approach across all asset classes. The financed emissions reported by a bank is calculated by determining the proportional share of lending and investment in the borrower or investee through an attribution factor and multiplying this to the emissions of the company/project/loan. The attribution factor is determined as the outstanding amount of the loan or investment over a defined valuation amount of the company/project/loan value the bank is invested in.

The Prevailing Issue of Data Quality

One of the primary ambitions of the Standard is to overcome the continual lack of consistency across CRFR reporting requirements but the perennial issue of unreliable and incomplete emissions data remains. While regions such as the EU have mandated domiciled companies to disclose their emissions data, this is not the case across the globe especially in developing nations. This has the potential to undermine the comparability and relevance of any GHG metric.

In this regard, the PCAF has established a data quality score table for each asset class that provides for proxies and estimations to overcome attribution factor and emission data limitations such as availability, transparency and reliability. Providing additional disclosure regarding the overall data quality of the metrics provided by banks will ensure analysts have transparency regarding the accuracy of these metrics.

Data Quality Scores for PCAF Defined Asset Classes

South Africa’s parliament ratified the Paris Agreement in 2016 and has recognised climate change as a significant threat to the economy. South Africa is now bound to commit towards reducing our emissions as a country over the next several decades which will invariably impact the activities of the financial sector. It is imperative that the financial sector is at the cutting edge of climate risk management and embraces the recommendations like those of the TFCD and PCAF especially as the consequences of transitional risk and regulatory intervention become increasingly pressing.

The Partnership for Carbon Accounting Financials’ Global GHG Accounting and Reporting Standard for the Financial Industry referenced in this article can be found at the link below:

[1] National Treasury. (2020). Financing a Sustainable Economy. Available at:

http://www.treasury.gov.za/publications/other/Sustainability%20technical%20paper%202020.pdf

[2] Ibid