About Monocle

Monocle is an independent, results-focused management consulting firm specialising in banking and insurance with two decades of experience working alongside industry leading companies around the world. With offices in London, Amsterdam, Cape Town and Johannesburg we service our clients across the United Kingdom, Europe, Scandinavia, Asia, South Africa and much of Sub–Saharan Africa.

Monocle has a proven capability in modernising and integrating the three core disciplines of finance, risk, and treasury – from data and processes, to business and regulatory requirements. We have extensive experience in leading accounting and data change projects through the design and implementation of cost allocation and management solutions. We enhance and optimise insurers’ financial reporting and data management strategies in order to comply with the various standards issued by the International Accounting Standards Board, as well as the design and implementation of cost allocation and management solutions.

Overview of cost allocation and transparency in IFRS 17

FRS 17 is set to update how insurers recognise, measure, present and disclose their insurance and reinsurance contracts to establish standardisation throughout the industry for greater transparency, risk management and comparability of results.

Measurement of insurance contracts uses a probability weighted discounted cash flow model and consists of three approaches:

-

General measurement mode

-

Premium allocation approach

-

Variable fee approach

An important consideration of IFRS 17 measurement and disclosure is appropriate cost measurement and classification. This includes calculating the Liability for Remaining Coverage (LRC) balance and the related Contractual Service Margin (CSM) as part of the GMM and VFA approaches as well as the Liability for Incurred Claims (LIC) and Insurance Service Expenses under all 3 approaches. Costs need to be analysed at a granular level, classified and allocated according to the IFRS 17 requirements.

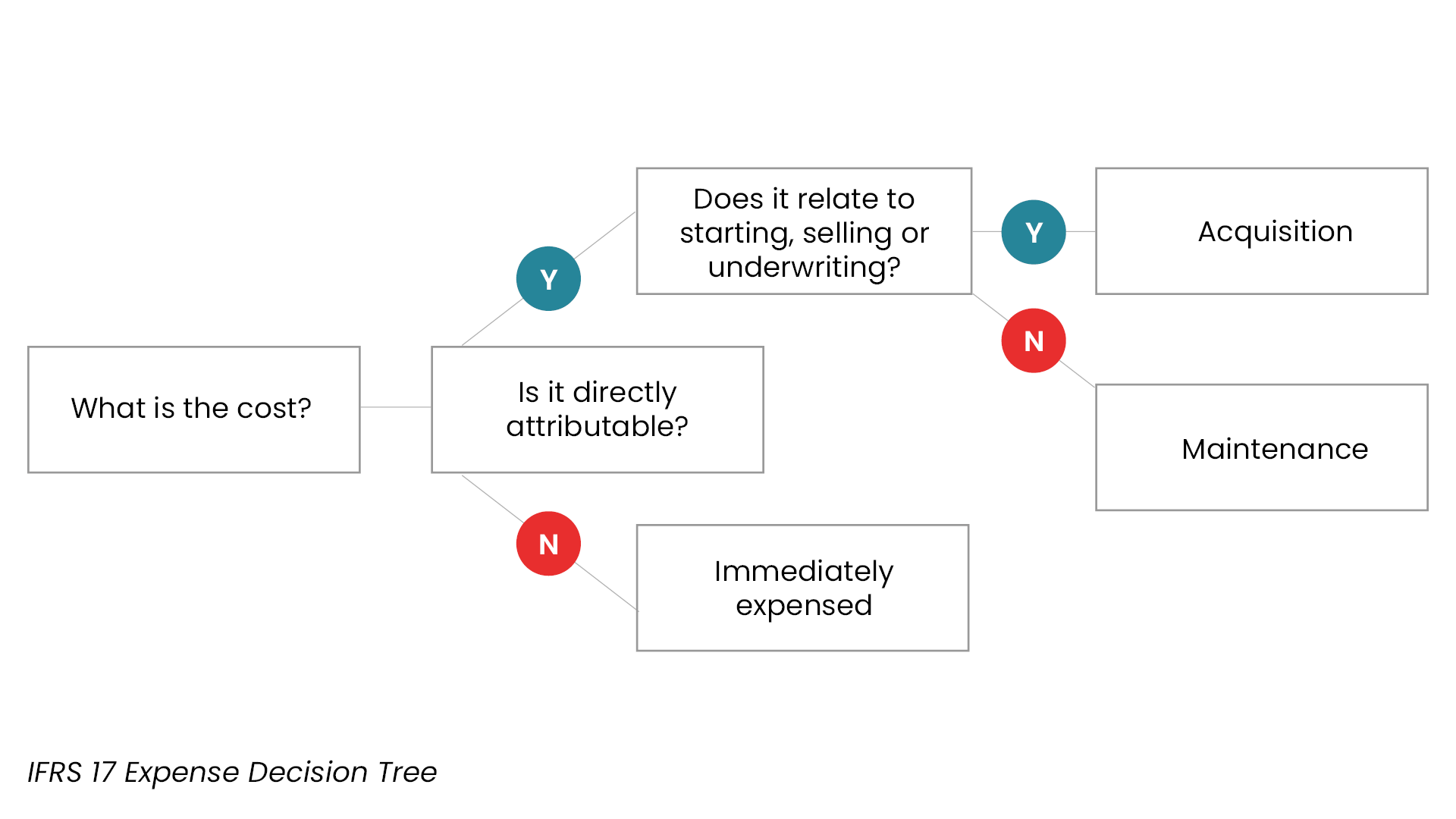

This cost analysis and management process will require insurers to determine whether costs are directly attributable to the insurance contracts aggregated at a portfolio, period and group level. According to the Standard, costs that are not directly attributable are immediately expensed.

Directly attributable costs are classified as either acquisition – relating to starting, selling or underwriting activities - or maintenance cash flows and are included in the measurement of insurance contracts. These costs form part of the cash outflows used to derive the liability for remaining coverage balance and the related contractual service margin.

Acquisition cash flows which relate to future renewals can be recognised as an asset until the future contracts are recognised. Acquisition cash flows are usually allocated to groups of contracts based on gross written premiums. However, expenses of an administrative policy maintenance nature are often allocated to groups of contracts based on the number of contracts in force within groups.

Key Challenges

Cost management is often facilitated through manual excel-based solutions which together with the complexity of the Standard leave insurers open to the following challenges:

-

Poor audit capabilities for manual excel-based cost allocation calculations (now an IFRS 17 requirement) and a lack of transparency around these calculations

-

Poor cost model methodologies and drivers impacting accuracy of results

-

Poor data quality and data governance practises

-

Granular data requirements including comprehensive historical data

-

Difficulty in identification of errors and breaks in the manual process (especially across multiple workbooks

-

Increased data reconciliation efforts across the process from the initial input data to final allocation of expenses

Monocle's approach

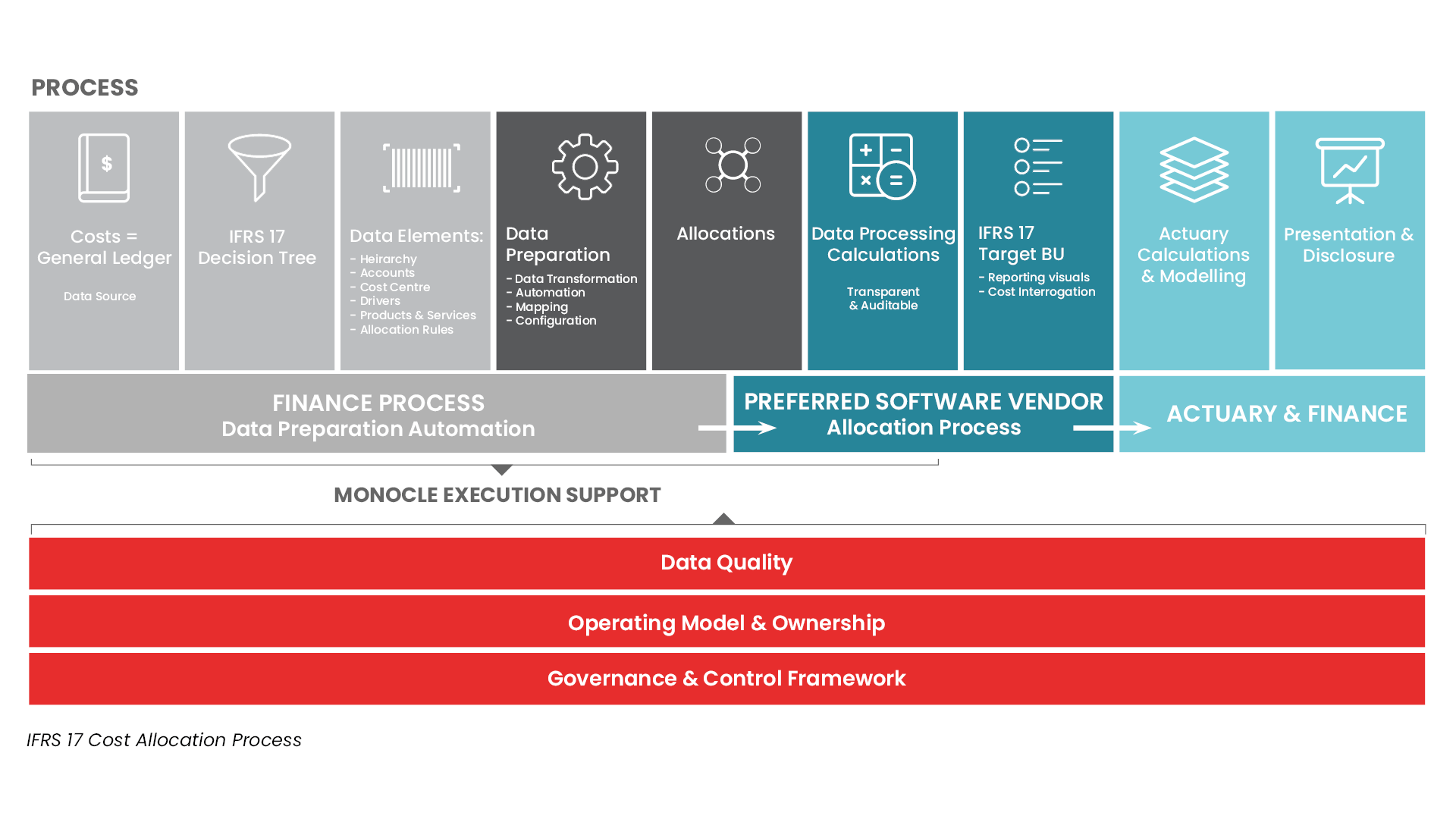

In order to execute effective IFRS 17 cost classification and allocation, insurers should design, implement, and embed an integrated and automated cost allocation platform. This provides a structured foundation that improves overall cost allocation efficiency and ensures accuracy, transparency, auditability and support of IFRS 17 readiness.

A cost allocation platform is designed to provide transparent and auditable cost processing calculations with automated system integration that support actuary calculations and modelling as well as financial disclosure and reporting.

Throughout implementation, Monocle aims to assist our clients across the costing lifecycle with specific focus on:

-

Comprehensive gap assessments from design of the IFRS 17 solution through to disclosure

-

Overall cost analysis and cost centre restructuring

-

Data identification, sourcing, and automated integration for all required inputs used in the cost models

-

Cost methodology design, testing and implementation of an automated solution

-

Scenario analysis to understand the difference between the current (as-is) process vs the future (to-be) IFRS 17 process

-

Custom report design and development

-

Disclosure and reporting analysis and optimisation

Our expertise ensures we assist our clients with their IFRS 17 deliverables throughout the business including the Finance, Actuarial and Operations.

How Monocle can assist?

Monocle has extensive experience in implementing accounting standards and data architectures within the banking and insurance industry. We are expertly positioned to assist insurers in the implementation of their cost allocation and management processes for IFRS 17. With our unique combination of business subject matter knowledge, strategic insights, and detailed understanding of financial data systems we are able to effectively partner with your preferred cost allocation software provider to create a cost solution that is fit-for-purpose and built to create long-term strategic value.